Introduction

In today’s fast-paced world, managing your finances effectively is key to building wealth and securing your future. With rising costs and economic uncertainties, more people are turning to investment and money management apps to track expenses, budget wisely, and grow their savings effortlessly. These tools make it easier than ever to take control of your money, whether you’re a beginner or seasoned investor.

What Are Investment & Money Management Apps?

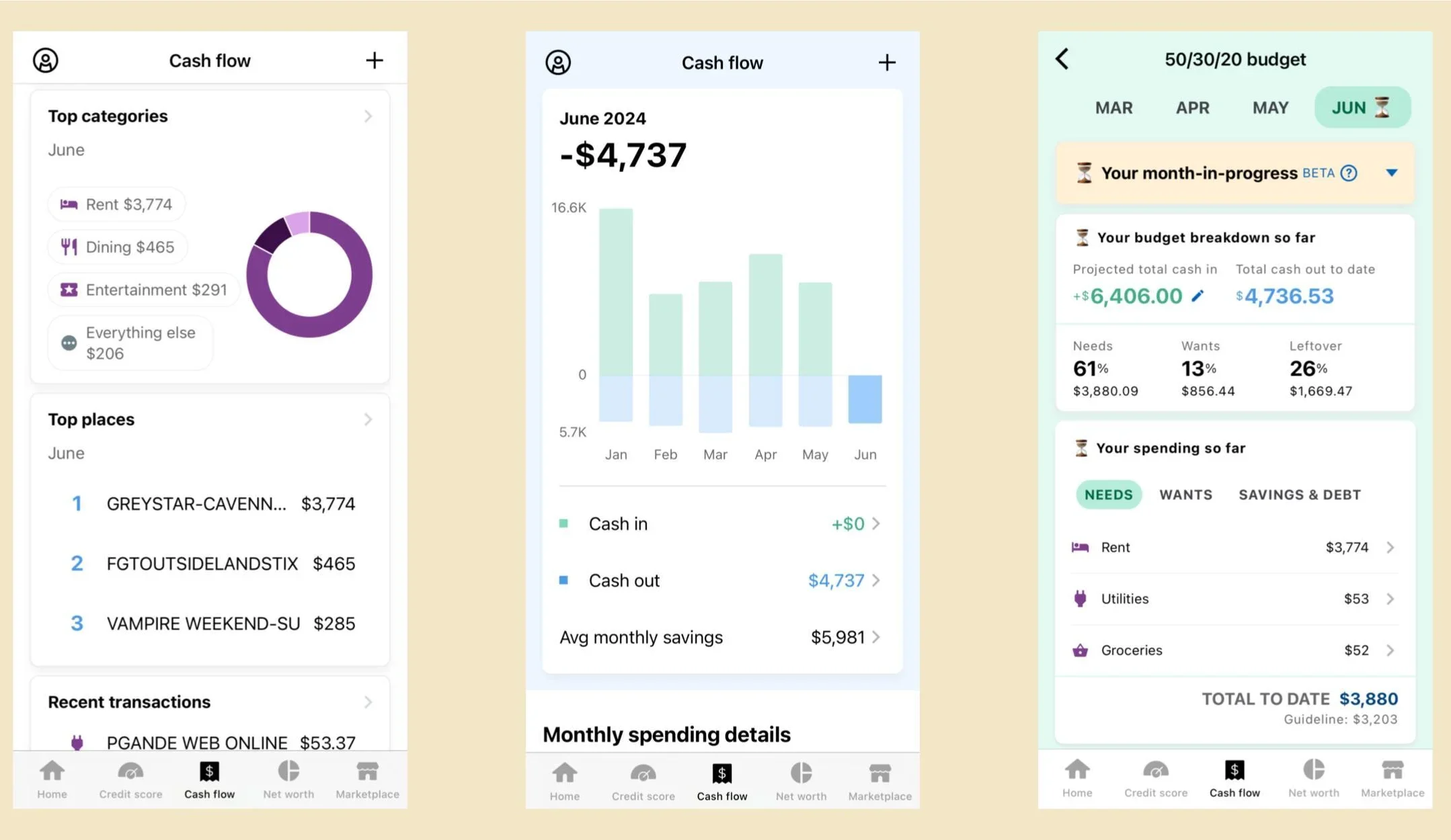

Investment and money management apps are digital tools designed to help users handle their finances, from daily budgeting to long-term investing. At their core, they simplify tracking income, expenses, and investments, often syncing with bank accounts for real-time updates. These apps cater to a wide audience, including young professionals saving for a home, families budgeting for vacations, or retirees optimizing their portfolios.

What sets them apart is their blend of user-friendly interfaces with powerful analytics, making complex financial tasks accessible. Unlike traditional banking, they often incorporate AI for personalized advice, turning your smartphone into a virtual financial advisor. Popular among millennials and Gen Z, these apps stand out by promoting proactive saving and investing habits in a category crowded with basic trackers.

Key Features

The best money management apps come packed with features that streamline your financial life. Here’s a look at some standout ones:

- Automated Budgeting: Categorizes expenses automatically and sets spending limits based on your income, helping you stay on track without manual input.

- Investment Tracking: Monitors stocks, ETFs, and other assets in real-time, with tools for portfolio diversification and performance analysis.

- Round-Up Savings: Rounds up everyday purchases to the nearest dollar and invests the spare change, making saving feel effortless.

- Goal Setting: Allows you to create custom financial goals, like building an emergency fund, with progress trackers and reminders.

- Bill Management: Scans and organizes bills, alerts you to due dates, and even negotiates lower rates on subscriptions.

- AI-Powered Insights: Provides personalized tips, such as identifying overspending patterns or suggesting investment opportunities based on market trends.

- Secure Syncing: Integrates with multiple accounts while using bank-level encryption for data protection.

These features focus on automation and intelligence, ensuring users get more than just basic tracking—they get actionable strategies to grow savings.

Benefits of Using Investment & Money Management Apps

Using investment and money management apps can transform how you handle your finances, offering convenience and smart strategies that fit into your busy lifestyle. They help you spot unnecessary expenses, automate savings, and make informed investment decisions, ultimately leading to faster wealth growth. For instance, by visualizing your spending habits, you can redirect funds toward high-yield savings or investments, potentially increasing your nest egg over time.

In daily life, these apps reduce stress by sending alerts for low balances or upcoming bills, freeing up mental space for other priorities. They also educate users on financial literacy through built-in resources, empowering better choices. Overall, they promote disciplined habits that compound into significant savings.

Key benefits include:

- Increased Savings: Automated tools like round-ups can add hundreds to your investments annually without effort.

- Better Investment Returns: Robo-advisors optimize portfolios for lower fees and higher efficiency.

- Time Efficiency: Quick overviews replace hours of manual spreadsheets.

- Financial Awareness: Detailed reports highlight trends, helping curb impulse buys.

- Accessibility: Available on mobile devices for on-the-go management.

- Customized Advice: Tailored recommendations based on your goals and risk tolerance.

Recent Trends

In 2025, investment and money management apps are embracing AI and automation more than ever, with features like predictive analytics that forecast cash flow and suggest adjustments before issues arise. Innovations include voice-activated commands for hands-free budgeting and deeper integrations with crypto wallets, reflecting the growing interest in digital assets. Apps are also focusing on sustainable investing options, allowing users to align portfolios with eco-friendly goals amid rising environmental awareness.

User needs are driving changes, such as enhanced accessibility for all ages and improved UI for intuitive navigation. Market shifts, like economic volatility, have led to better fraud detection and real-time market alerts. Looking ahead, expect more emphasis on holistic financial wellness, combining mental health tips with money management to support overall well-being.

Pros of Investment & Money Management Apps

| Pros | Description |

|---|---|

| Easy to Use | Intuitive interfaces make them accessible for beginners and experts alike. |

| Time Saving | Automates tracking and analysis, freeing up hours for other activities. |

| Reliable Performance | Most run smoothly with regular updates to fix bugs and enhance speed. |

| Offline Support | Some features work without internet, allowing access anytime. |

| Regular Updates | Developers add new tools like AI insights to keep apps current. |

| Free Version Available | Basic functions are often free, with premium upgrades for advanced needs. |

Cons of Investment & Money Management Apps

| Cons | Description |

|---|---|

| Limited Free Features | Advanced tools like detailed investment advice often require a subscription. |

| Ads in Free Version | Non-paying users might see occasional promotions disrupting the experience. |

| Requires Permissions | Needs access to bank data and location, raising privacy concerns for some. |

| Occasional Bugs | Updates can introduce temporary glitches affecting usability. |

| Large File Size | Some apps consume significant storage, especially with added features. |

| Internet Needed | Core syncing and real-time updates depend on connectivity. |

Alternatives of Investment & Money Management Apps

| Alternative | Description |

|---|---|

| Monarch Money | A comprehensive budgeting app with net worth tracking, custom categories, and collaborative features for families, ideal for long-term planning. |

| YNAB (You Need A Budget) | Focuses on zero-based budgeting to allocate every dollar purposefully, great for hands-on users aiming to break debt cycles. |

| Acorns | Specializes in micro-investing by rounding up purchases and investing spare change, perfect for beginners building savings passively. |

| Betterment | A robo-advisor offering automated portfolio management with tax optimization, suited for those seeking low-effort investing. |

| Rocket Money | Excels at subscription management and bill negotiation, helping users cut costs while providing solid budgeting tools. |

Cost & Value Factors

Most investment and money management apps follow a freemium model, where basic features like expense tracking are free, but premium tiers unlock advanced options such as unlimited custom budgets or investment advice. Pricing typically ranges from $5 to $15 per month, or $50 to $100 annually, with factors like app complexity, user base size, and added services influencing costs. For example, apps with AI-driven investing might charge more due to sophisticated algorithms.

To get the best value, look for trials or annual discounts, and assess if premium features align with your needs—such as portfolio rebalancing for investors. Compared to alternatives like hiring a financial advisor, these apps are far more affordable, often delivering similar insights at a fraction of the cost. They’re worth it if they help you save or earn more than the subscription fee, making them a smart choice for proactive users.

Mistakes to Avoid

When using investment and money management apps, it’s easy to slip into habits that undermine their effectiveness. Here are common pitfalls and how to steer clear:

- Ignoring Notifications: Many users dismiss alerts about overspending or market changes; set aside time daily to review them for timely adjustments.

- Not Verifying Data: Relying solely on auto-categorization without checking can lead to errors; periodically audit transactions for accuracy.

- Overcomplicating Goals: Setting too many objectives overwhelms the system; start with 2-3 key goals and build from there.

- Skipping Security Setup: Forgetting two-factor authentication exposes accounts; always enable it and use strong passwords.

- Neglecting Updates: Outdated apps miss bug fixes and new features; enable auto-updates to stay current.

- Linking Too Many Accounts: This can clutter the interface; begin with essentials and add more as needed.

- Chasing Trends Blindly: Following app suggestions without research; always cross-check advice with your financial situation.

Final Thoughts

From automated budgeting to smart investing, best investment and money management apps offer powerful ways to grow your savings and achieve financial freedom. We’ve covered their features, benefits, trends, and even pitfalls, highlighting how they adapt to modern needs while providing real value. Remember, the key is consistent use—start small, stay engaged, and watch your efforts pay off. Take that first step today toward a brighter financial future; you’ve got this!